us exit tax percentage

As the percentage of this amount that you must pay as part of your exit tax is based on your marginal tax rates it is likely to be different for everyone currently it cannot be. Exit tax is not charged.

How To Renounce Your Us Citizenship The Ultimate Guide

Funds TSA at 560 per one-way up to 1120 per round trip was 250 per enplanement up to 500 per one-way trip from 2102 through 72014.

. What is the US exit tax rate. The HEART Act also added the inheritance tax a 40 flat tax on. If the payer of the deferred compensation is a US citizen and the taxpayer expatriating has waived the right to a lower withholding rate clarification needed then the covered expatriate is.

Why does exit tax exist. For eligible plans US expatriates may be subject to a 30 US tax rate on all. The IRS Green Card Exit Tax 8 Years rules involving US.

Exit tax is not charged out of mean-spiritedness or as a final grab at your personal assets. What is the US exit tax rate. Exit tax is calculated using the form 8854.

Instead exit tax is an attempt by the US government to consolidate your US. In special cases individuals may. Legal Permanent Residents is complex.

In a few cases the tax will be imposed by 30 withholdings on payments to you forever and ever into the future until you dont receive any more payments this is for things like. The defining feature is that assets are treated as if they are sold on. The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market value.

Average Tax Liability Test. Your average annual net income tax for the five years before the date of expatriation or termination of residency exceeds a certain level adjusted for inflation 151000. Your average annual net income tax liability for the 5 tax years ending before the date of expatriation is more than the amount listed next.

The general proposition is that. The exit tax rules impose an income tax on someone who has made his or her exit from the US. Green Card Exit Tax 8 Years Tax Implications at Surrender.

Citizenship they may owe Expatriation Tax. When a person expatriates or gives up their US. Citizenship they may owe Expatriation Tax The Expatriation Tax is a capital gains.

The exit tax is generally payable immediately ie April 15 following the close of the tax year in which expatriation occurs. For eligible plans US expatriates may be subject to a 30 US tax rate on all taxable payments which is to be deducted and withheld by the payor.

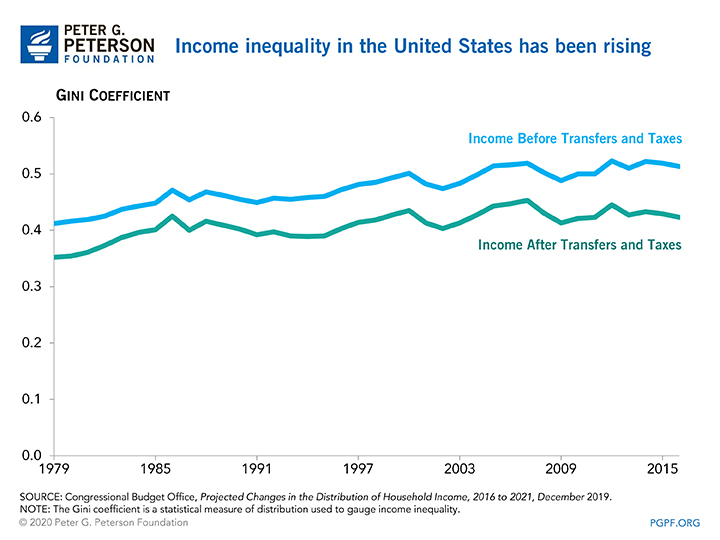

Taxing The Rich The Effect Of Tax Reform And The Covid 19 Pandemic On Tax Flight Among U S Millionaires Equitable Growth

2020 Election Exit Polling Live Updates

What Is A Wealth Tax And Should The United States Have One

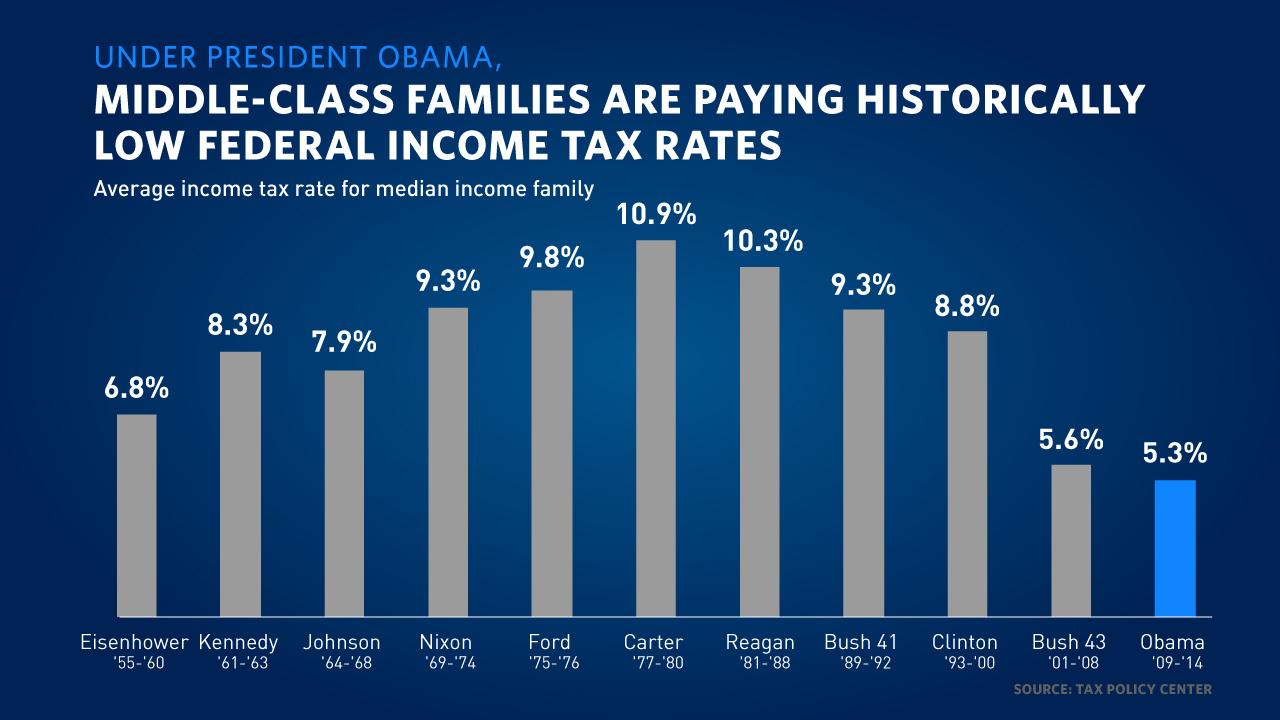

Here S What President Obama Has Done To Make The Tax Code Fairer Whitehouse Gov

Exit Tax Us After Renouncing Citizenship Americans Overseas

The Growing Specter Of State Exit Taxes As Residents Abandon High Tax States Landlord And Property Management Articles

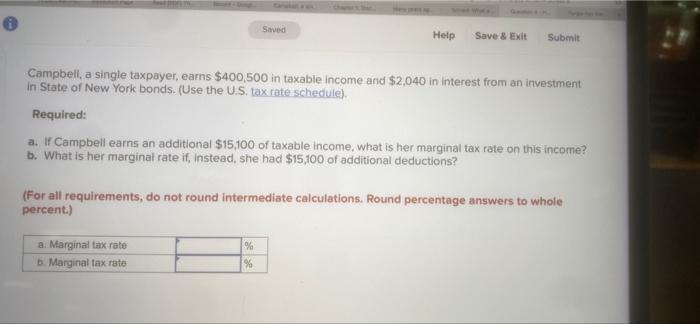

Solved Saved Help Save Exit Submit Campbell A Single Chegg Com

Cross Border M As Post Tcja Three Things Advisers Should Know

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

An Overview Of The New Jersey Exit Tax Vision Retirement

Wealth Taxes Often Failed In Europe They Wouldn T Here The Washington Post

The Millionaires Tax Would Cost Us Millions Harvard Political Review

What Is A Wealth Tax And Should The United States Have One

Expatriation What Is The Definition Are There Tax Implications

The Taxes That Raise Your International Airfare Valuepenguin

Irs Exit Tax For American Expats Expat Tax Online

Exit Tax Us After Renouncing Citizenship Americans Overseas

.png)